In the first full week of June (week 23: 2–8 June), air cargo tonnages from China and Hong Kong (CN/HK) to the US dropped sharply by -10% week-on-week (WoW) and were -19% lower year-on-year (YoY), according to WorldACD Market Data. Spot rates on this lane also declined significantly, down -5% WoW and -17% YoY. This sharp drop followed a brief recovery in late May, which appears to have been temporary, likely driven by a short-term catch-up in volumes after the pause in US import tariffs on CN/HK goods.

The volatile CN/HK to US market was a major factor in a -3% global decline in air cargo tonnages in week 23. China’s overall tonnages dropped -7% WoW, largely from southern China, where e-commerce is a key driver. Asia Pacific volumes fell -4% WoW, with Southeast Asia down -6% due to Eid Al-Adha holidays, notably impacting Malaysia (-14%) and Indonesia (-10%). South Korea also saw a -6% decline tied to its Memorial Day on 6 June.

Cargo tonnages from mainland China to Europe declined -5% WoW, though Hong Kong to Europe showed a modest +2% increase. However, other key Asian markets saw steep drops: South Korea to Europe fell -16%, Malaysia -26%, and Indonesia -24%, all influenced by local holidays.

Outbound cargo from Europe and the Middle East & South Asia (MESA) also declined, by -4% and -8% respectively, impacted by the Pentecost holiday in Europe and Eid in MESA, particularly affecting intra-MESA (-26%) and MESA to Africa (-17%) traffic. A +8% WoW recovery in traffic from North America was recorded, rebounding from Memorial Day-related lows in late May.

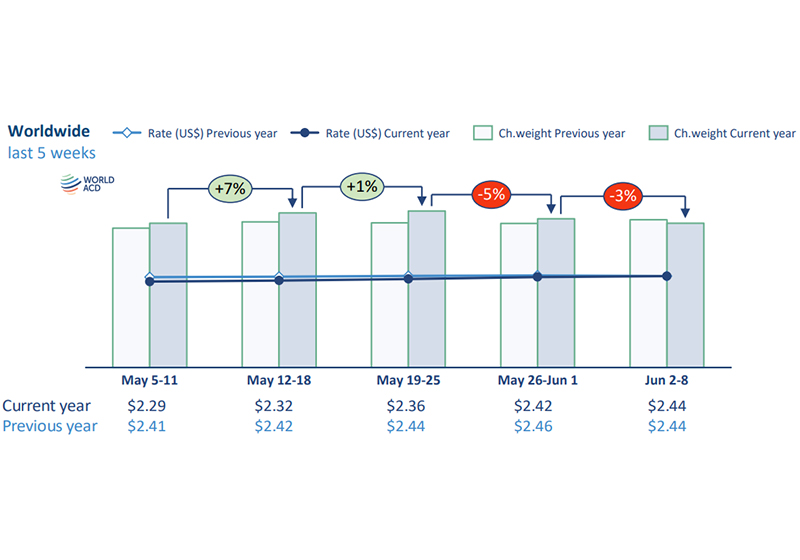

Globally, air cargo rates remained relatively stable in week 23, with the average rate at $2.44 per kilo (+1% WoW), matching levels from the same week last year. Spot rates rose slightly to $2.63/kg (+2% WoW), with minimal YoY change (+1%). However, Hong Kong to US spot rates dropped sharply by -12% WoW, reflecting the impact of stricter US ‘de minimis’ rules for low-value shipments from CN/HK, which have increased costs and reduced competitiveness for e-commerce traffic.