Average worldwide air cargo rates rose by +2% in June, month on month, taking them -1% below their level in June 2024, based on a full market average of spot rates and contract rates. Especially air cargo rates to the US from Asia Pacific countries other than China rose significantly in June, according to preliminary June figures from WorldACD Market Data, as markets continue to adjust to volatile US trade and tariff policies.

Average full-market rates from Asia Pacific countries excluding China and Hong Kong to the US rebounded to US$5.19 per kilo in June, an increase of around +10% compared with the previous month and their level in June 2024. In contrast, tonnages from China and Hong Kong to the US in June were down by around -15% compared with their level in March, prior to the introduction of higher US tariffs, and around -11% below their level in June 2024. Average rates from China and Hong Kong to the US dropped to around $4.29 per kilo in June compared with $4.73 at the start of the year and $5.10 per kilo in June 2024, a fall of -16%, year on year (YoY), based on the more than 500,000 weekly transactions covered by WorldACD’s data.

In comparison, tonnages flown from China and Hong Kong to Europe have continued to rise, in June reaching their highest levels this year and taking them +15% higher than their level in June 2024. And average rates from China and Hong Kong to Europe were stable at $3.97 per kilo, similar to their level the previous month and their average level so far this year, but down -3% YoY.

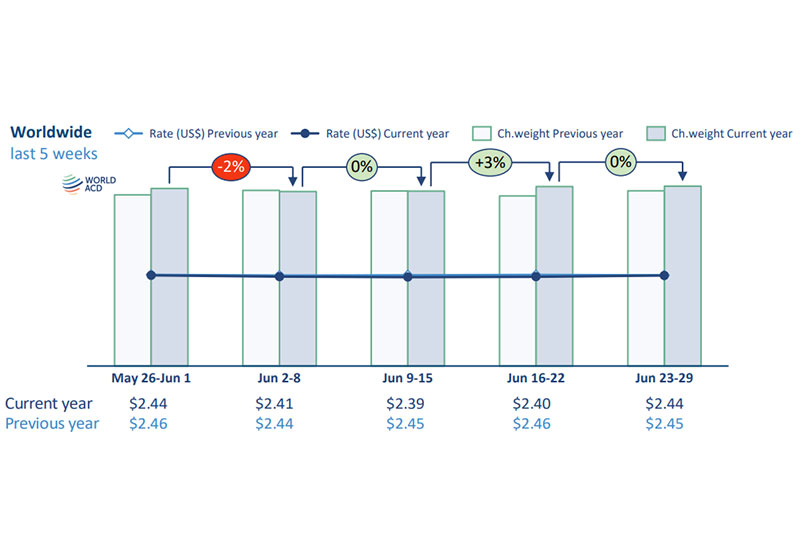

On a global basis, worldwide flown air cargo tonnages in June were +2% higher than in June last year, although they fell by -4% compared with the previous month. Preliminary figures for the second quarter (Q2) of 2025 indicate that worldwide flown chargeable weight in the three months to 30 June was up by +4%, on both a year-on-year (YoY) and quarter-on-quarter (QoQ) basis. To put this into perspective, in 2023 and 2024, the chargeable weight in the second quarter was in both years +3% higher than the first quarter. Average rates in Q2 2025 rose by +1%, QoQ, although they dropped by -1%, YoY. For the first six months of 2025, both rates and tonnages increased, YoY, with chargeable weight up by +3% and average freight rates +2% higher.

That surge in the market share of spot rates for the Asia Pacific to US market reflects an increasing disparity between the level of contract rates and spot rates, as carriers have struggled to accurately match capacity with demand in what has been a highly volatile market because of the rapidly changing tariff landscape and the end of ‘de minimis’ exemptions for US imports of goods from China and Hong Kong. Whereas spot rates and contract rates had been more or less aligned at the start of the year, by June average contract rates of US$5.28 per kilo stood around +13% higher than average spot rates of $4.66 per kilo.